Custom Code

Grow your business with the name shoppers trust.

Offer all major payment options

with one easy checkout solution

PayPal Payments

Major Credit and Debit Cards

Give your sales a boost with Pay Later

What Pay Later can mean for your Bottom Line

-

63%

More likely to purchase

Almost two-thirds of buy now, pay later (BNPL) users say they are more likely to complete a purchase if a BNPL option is available.7 -

56%

increase in average order value.

Businesses with pay-over-time messaging on their site saw a 56% increase in overall PayPal AOV.5 -

84%

look for it before checkout.

The majority of buy now, pay later (BNPL) users decide to use a BNPL solution prior to checkout.8

PayPal is one of the world’s most preferred, trusted, and familiar brands

20+

years of experience

200+

markets around the globe

100+

different currencies

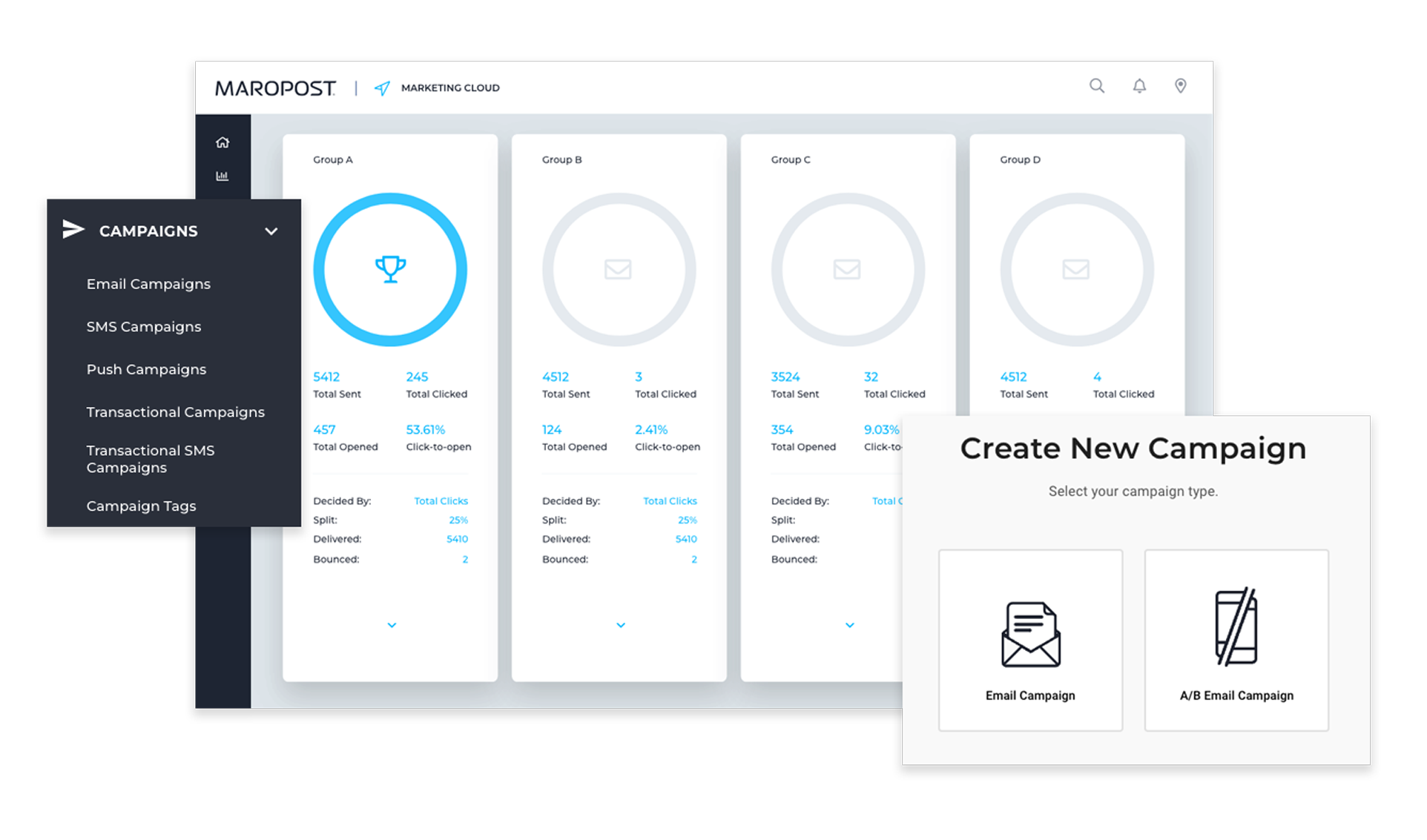

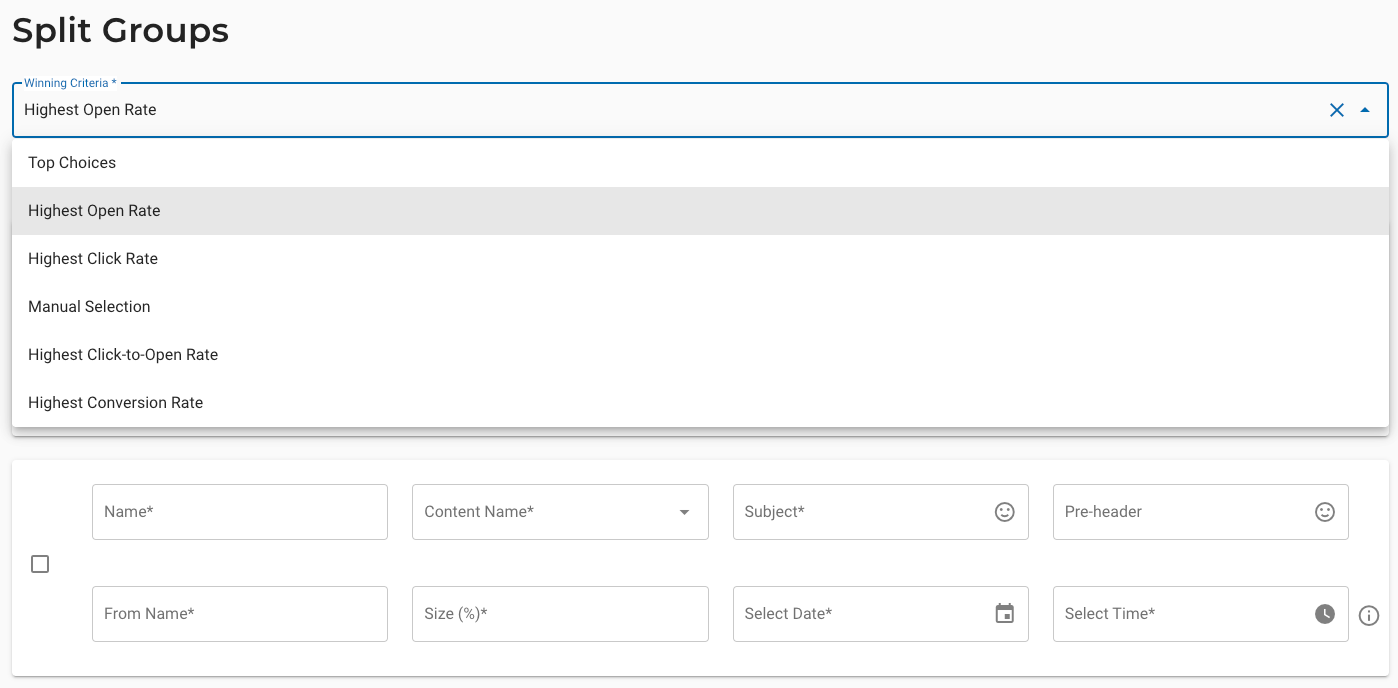

Boost email performance with multivariate testing

Avoid friction with our easy checkout process

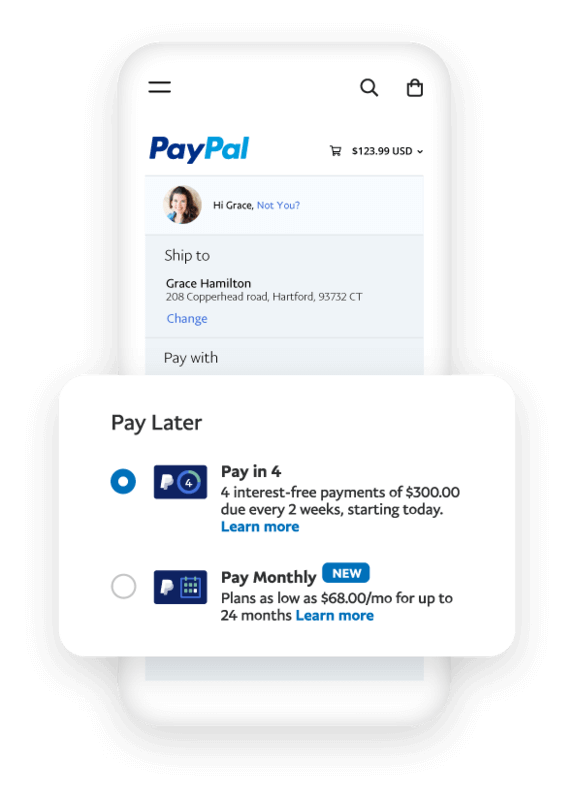

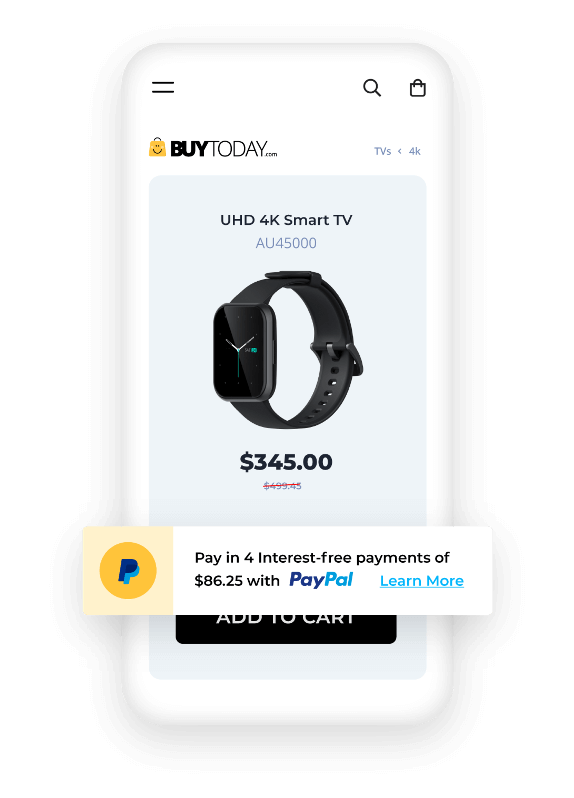

Show dynamic Pay Later messaging on your site.

Your customer sees the most relevant Pay Later option.

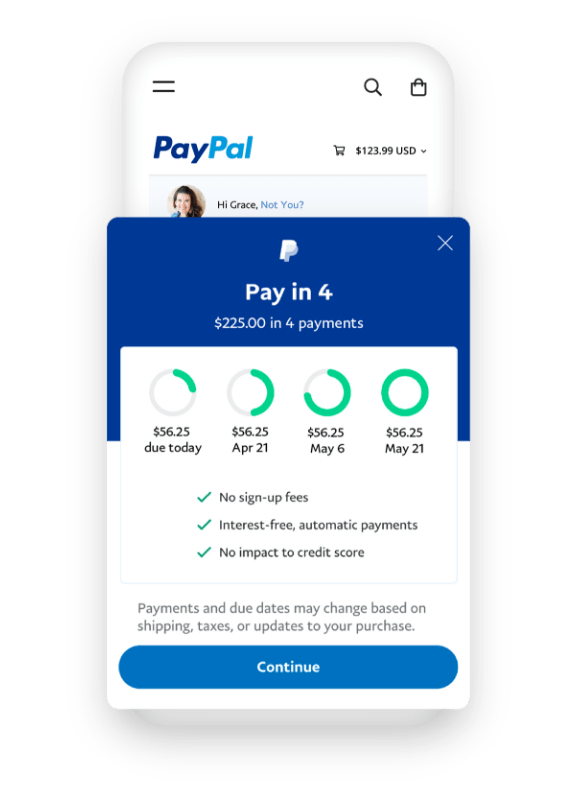

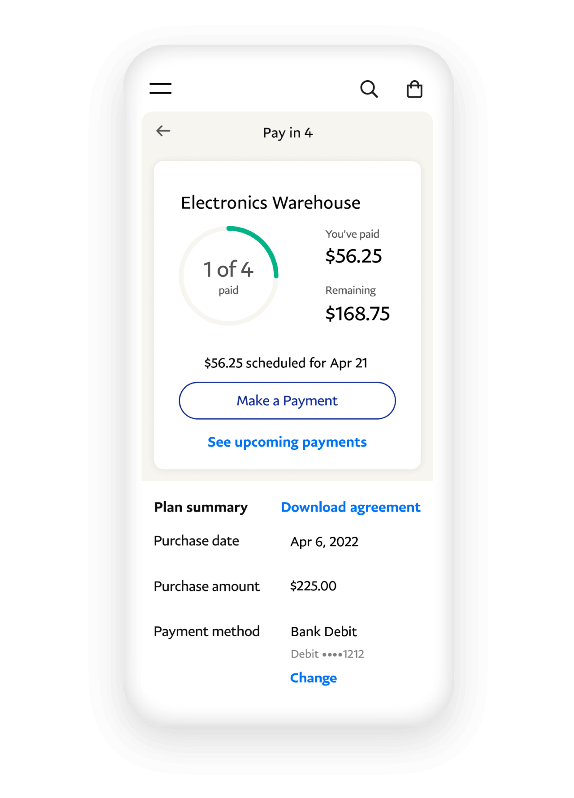

Customers get clear payment information.

Pay in 4 or Pay Monthly payments are clearly presented.

PayPal does the rest.

*About Pay in 4: Loans to California residents are made or arranged pursuant to a California Financing Law License. PayPal, Inc. is a Georgia Instalment Lender Licensee, NMLS #910457. Rhode Island Small Loan Lender Licensee.

Pay Monthly is subject to consumer credit approval. 9.99-29.99% APR based on the customer’s creditworthiness. PayPal, Inc.: RI Loan Broker Licensee. The lender for Pay Monthly is WebBank.

162% of BNPL users say that seeing a buy now, pay later message while shopping encouraged them to complete a purchase. TRC online survey commissioned by PayPal in April 2021 involving 5,000 consumers ages 18+ across US, UK, DE, FR, AU (among BNPL users, US (n=282), UK (n=303), DE (n=342), AU (n=447), FR (n=255)).

2PayPal's Pay Later is boosting merchant conversion rates and increasing cart sizes by 39%. PayPal Q2 Earnings-2021.

380% of BNPL users agree that seeing a BNPL message while browsing gives them the ability to spend more. An online study commissioned by PayPal and conducted by Netfluential in November. 2020, involving 1,000 US online shoppers ages 18-39. (Among BNPL Users, n= 357).

474% of BNPL users are more likely to shop at a merchant again if they offer a buy now, pay later option. TRC online survey commissioned by PayPal in April 2021 involving 1000 US consumers ages 18+ (among BNPL users, n=282).

5PayPal is the most trusted brand across BNPL payment providers. An online study commissioned by PayPal and conducted by Netfluential in November 2020, involving 1,000 US online shoppers ages 18-39.

6The Truth About BNPL And Store Cards Report, an online study commissioned by PayPal and conducted by PYMNTS, based on a census- balanced survey of 2,161 U.S. consumers from Dec. 10 to Dec. 17, 2021.

7TRC online survey commissioned by PayPal in April 2021 involving 5,000 consumers ages 18+ across US, UK, DE, FR, AU (among BNPL users, US (n=282), UK (n=303), DE (n=342), AU(n=447), FR (n=255).

884% of BNPL users decide to use a buy now pay later solution prior to checkout. An online study commissioned by PayPal and conducted by Netfluential in November 2020, involving 1,000 US online shoppers ages 18-39. (Among BNPL users, n=357).

The PayPal service is provided by PayPal Australia Pty Limited (ABN 93 111 195 389) which holds Australian Financial Services Licence number 304962. Any information provided is general only and does not take into account your objectives, financial situation or needs. Please read and consider the Combined Financial Services Guide and Product Disclosure Statement before acquiring or using the service. To review the Target Market Determination, see website.

NOTE:

PayPal Pay in 4 is a continuing credit contract provided by PayPal Credit Pty Limited (ABN 66 600 629 258; Australian Credit Licence Number 568848) and is subject to merchant and customer eligibility criteria. Full terms and details are available in the PayPal Credit Guide, TMD and PayPal Pay in 4 Facility Agreement on our website.